Category: Home Financing

-

Home Equity Loan or HELOC: Choosing the Best Fit for Your Needs

Understand how home equity loans and HELOCs work, their advantages, and potential drawbacks to make informed financial decisions. For homeowners looking to tap into their property’s value, home equity loans (HELs) and home equity lines of credit (HELOCs) provide distinct avenues. Each option serves different purposes and suits different financial strategies. Knowing the differences, benefits,…

-

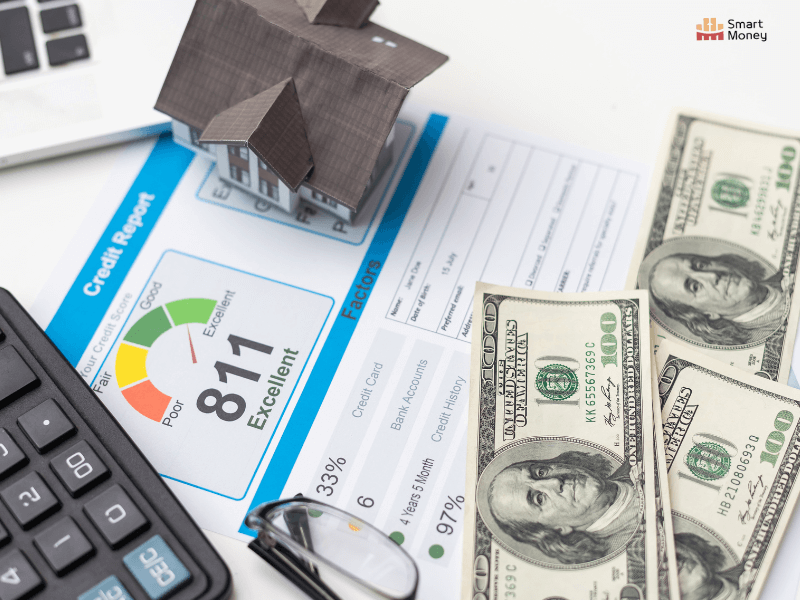

Why It’s Essential to Improve Your Credit Score Before Buying a Home

Discover how your credit score impacts mortgage costs and learn practical steps to improve it. Save thousands with tips from SmartMoney.ink!

-

Mortgage Refinancing : How Much Would It Save You?

With the Potential to Unlock $$$ of Savings, Could Mortgage Refinancing Be a Smart Move for You? Read on, for Everything you Need to Know. A refinance means replacing your current mortgage with a new one, often to get a lower interest rate or better terms. Refinancing can save you money over time if you…

-

All You Need to Know About Securing a Mortgage

For most of us, purchasing a home outright with cash is an unrealistic dream. This is where mortgages come in. They provide the funds to make homeownership a reality. Essentially, a mortgage is a specific type of loan designed for home purchases. Many types of mortgages exist for different needs. But, conventional home loans are…

-

10 Crucial Questions to Ask Your Mortgage Lender

Essential Questions to Ask Your Mortgage Provider Before ApplyingYou’ve narrowed your list of lenders or been pre-qualified for a mortgage. The next step is to begin your formal mortgage application. However, before diving in, it’s crucial to prepare the right questions to ask your lender. Here are 10 essential questions to guide you: 1. What…